Hey Reader,

Did you know just one supportive conversation can lower cortisol levels in the brain?

That’s the power of connection. As we honor Mental Health Awareness Month this May, there's no better time to gift someone that exact moment of care and clarity.

What is it?

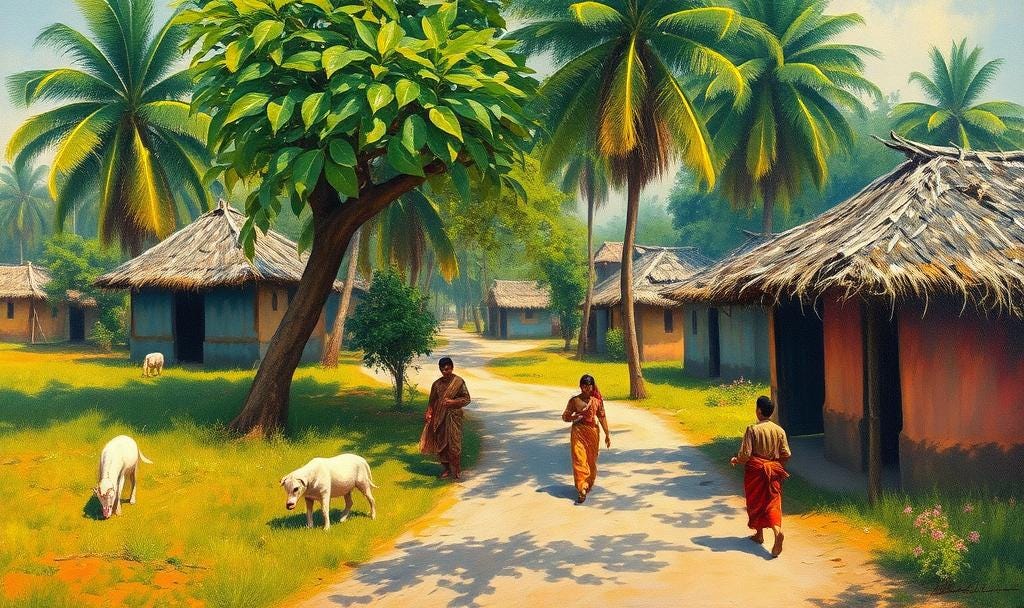

The researchers used a unique dataset from rural Tamil Nadu that tracks people over time and includes info on their personality, cognitive abilities, and debt.

They wanted to see if things like conscientiousness (being organized and responsible) or numeracy (math skills) influenced how people deal with their debt.

Key Findings:

Conscientiousness is Helpful: Being conscientious is a big advantage for women from non-Dalit castes when negotiating and managing debt.

Emotional Stability is a Downside: Surprisingly, being emotionally stable seems to be a disadvantage in dealing with debt.

Cognitive Skills are Mixed: The Raven score (a measure of logical reasoning) was negatively linked to debt negotiation but positively linked to debt management.

The paper also mentions that the social context matters, social identity such as caste and gender plays a role in how cognitive skills are related to indebtedness.

Support this newsletter by buying the psychology handbook!👇

This Handbook explains 150+ biases & fallacies in simple language with emojis.

Or the Amazon Kindle copy from here.

What do I need to know:

Your personality traits and cognitive skills can influence how you manage debt.

Social identity such as caste and gender can influence cognitive skills and indebtedness.

Training programs to boost conscientiousness might help people in debt, especially women, but should be integrated into a larger policy to rebalance the debt burden.

Policies should develop reliable and universal social protection system so that even the most vulnerable households can avoid going into debt for everyday expenses.

Source:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5038224